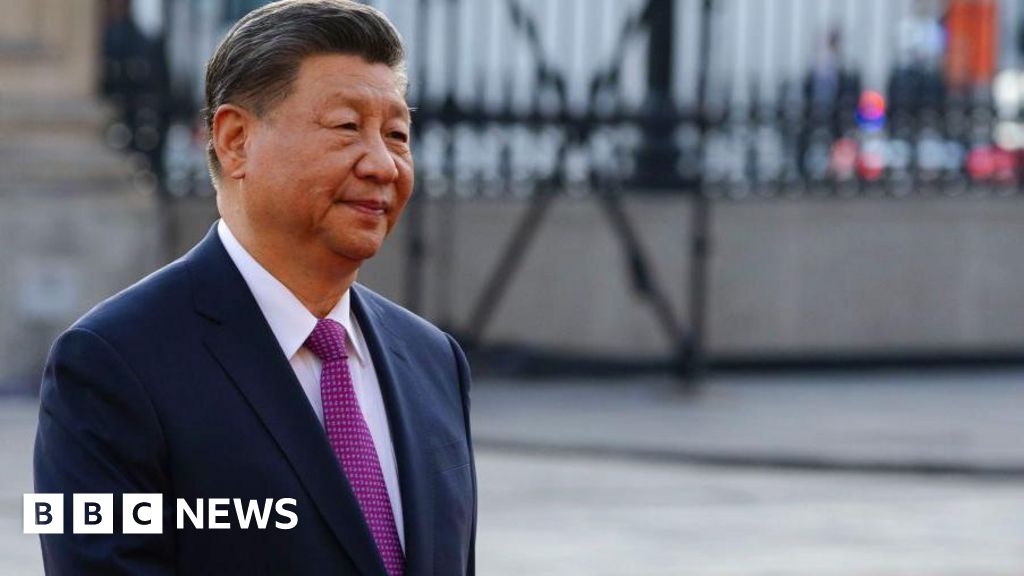

Yvette Tan, Annabelle Liang and Kelly NgGetty Images

Xi Jinping has not shown any indication that he will back down first in the tariff standoff with the US

The trade war between the top two global economies continues to escalate – Beijing has pledged to “fight to the end” shortly after US President Donald Trump threatened to almost double the tariffs on China.

This could result in most Chinese imports facing a significant 104% tax increase, marking a sharp escalation in tensions.

Products such as smartphones, computers, lithium-ion batteries, toys, and video game consoles constitute a large portion of Chinese exports to the US. However, a wide range of other items, from screws to boilers, are also affected.

As the deadline in Washington approaches and Trump threatens to implement additional tariffs starting Wednesday, the question remains: who will give in first?

Alfredo Montufar-Helu, a senior advisor at The Conference Board think tank’s China Center, warns, “It would be a mistake to assume that China will back down and remove tariffs unilaterally. This impasse is likely to result in long-term economic consequences.”

Global markets have been volatile since Trump’s tariffs began taking effect, with Asian stocks experiencing a significant drop on Monday before recovering slightly on Tuesday.

China has retaliated with tit-for-tat levies of 34%, and Trump has threatened an additional 50% tariff if Beijing does not yield.

The uncertainty surrounding the situation is high, with more tariffs set to come into effect, potentially impacting Asian economies significantly.

Experts are concerned about the rapid escalation of tensions, leaving governments, businesses, and investors little time to adapt to a changing global economy.

How is China responding to the tariffs?

China has responded to previous Trump tariffs with retaliatory measures, including export controls and investigations into US firms. This time, China is bracing for impact by allowing its currency to weaken and stabilizing the market through state-linked enterprises buying stocks.

Getty Images

China exports a variety of goods to the US, from silk to smartphones

Hope for negotiations between the US and Japan has provided some relief to investors amid the ongoing trade tensions.

However, the standoff between China and the US remains a significant concern due to their economic interdependence.

Mary Lovely, a US-China trade expert, notes, “What we are witnessing is a test of endurance rather than a pursuit of gain.”

Despite China’s slowing economy, the country may be willing to endure the pain to avoid yielding to what it perceives as US aggression.

The tariffs could worsen existing economic challenges in China, affecting crucial revenue streams and potentially impacting the country’s growth trajectory.

The impact of the tariffs is expected to be felt soon, adding pressure to the already strained economic conditions.

It goes both ways

The repercussions of the trade war are not limited to China, as the US also stands to feel the effects.

The US imported a substantial amount of goods from China in 2024, resulting in a trade deficit between the two countries.

Getty Images

China is the world’s biggest exporter – and that has played a big role in its rapid economic growth

Finding alternative suppliers for Chinese goods on short notice poses a challenge for the US.

Both countries are deeply intertwined economically, with significant investments, digital trade, and data flows between them.

The ongoing trade tensions have global implications, with other countries observing closely to see how Chinese exports redirected from the US market will impact their economies. Yvette Tan, Annabelle Liang dan Kelly NgGetty Images

Mereka akan berakhir di pasar lain seperti di Asia Tenggara, Ms Elms menambahkan, dan “tempat-tempat ini [sedang] menghadapi tarif mereka sendiri dan harus memikirkan di mana lagi kita bisa menjual produk-produk kita?”

“Jadi kita berada di alam semesta yang sangat berbeda, yang sangat kabur sekali.”

Bagaimana ini akan berakhir?

Berbeda dengan perang dagang dengan China selama masa jabatan pertama Trump, yang berkaitan dengan negosiasi dengan Beijing, “tidak jelas apa yang memotivasi tarif ini dan sangat sulit untuk memprediksi ke mana hal-hal ini mungkin akan berakhir,” kata Roland Rajah, ekonom utama di Lowy Institute.

China memiliki “alat yang luas” untuk balasan, tambahnya, seperti menurunkan nilai mata uang mereka lebih jauh atau menindak tegas perusahaan-perusahaan AS.

“Saya pikir pertanyaannya adalah seberapa terbatas mereka? Ada balasan untuk menjaga wajah dan ada menarik keluar seluruh senjata. Belum jelas apakah China ingin melangkah ke arah itu. Mungkin saja.”

Getty Images

Indeks Shanghai jatuh lebih dari 7% pada hari Senin ketika saham-saham Asia merosot

Beberapa ahli percaya bahwa AS dan China mungkin akan terlibat dalam pembicaraan pribadi. Trump belum berbicara dengan Xi sejak kembali ke Gedung Putih, meskipun Beijing telah berulang kali menunjukkan kesediaannya untuk berbicara.

Tapi yang lain kurang berharap.

“Saya pikir AS terlalu memainkan tangannya,” kata Ms Elms. Dia skeptis terhadap keyakinan Trump bahwa pasar AS begitu menguntungkan sehingga China, atau negara manapun, akhirnya akan tunduk.

“Bagaimana ini akan berakhir? Tidak ada yang tahu,” katanya. “Saya sangat khawatir tentang kecepatan dan eskalasi. Masa depan jauh lebih menantang dan risikonya begitu tinggi.”